6th June, 2025

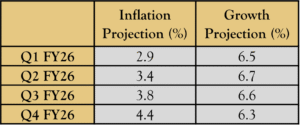

Summary: In a surprise move, the RBI cut the repo rate by 50 basis points to 5.5% in its June MPC meeting, marking the third consecutive cut in 2025 and taking the cumulative reduction to 100 bps YTD. The central bank shifted its stance from ‘Accommodative’ to ‘Neutral’ while lowering the CPI inflation forecast for FY26 to 3.7% (from 4%) and maintaining GDP growth projection at 6.5%.

This outsized cut, higher than market expectations, aims to boost credit flow and support growth amid softening inflation and persistent global uncertainty. Sectors like real estate and autos are likely beneficiaries, as lower borrowing costs improve demand prospects. The bond market also rallied, anticipating further monetary support.

The Reserve Bank of India (RBI) has announced a 100 basis point cut in the Cash Reserve Ratio (CRR), bringing it down from 4% to 3%. This move is aimed at boosting liquidity within the banking sector and enhancing the effectiveness of monetary policy transmission. The reduction will be rolled out in four equal phases of 25 basis points each, beginning September 6, 2025, and ending November 29, 2025. By the conclusion of this schedule, it is anticipated that around ₹2.5 trillion will be infused into the banking system.

Additionally, in line with the repo rate reduction, the Standard Deposit Facility (SDF) and Marginal Standing Facility (MSF) rates have also been revised downward by 50 basis points.

Inflation & Growth Projection

Market Reaction

Markets welcomed the pro-growth pivot, with the Sensex rising 747 pts (0.92%) and Nifty crossing 25,000. Rate-sensitive sectors led gains—Nifty Realty jumped 4.7%, followed by Financial Services (+1.75%), Auto (+1.5%), and Metal (+1.9%). Broader indices also closed higher, while India VIX dipped, suggesting lower volatility expectations.

While the move offers immediate tailwinds,markets flagged the possibility of near-term pressure on bank margins and the importance of transmission. Still, the RBI’s stance signals clear intent to anchor growth momentum as India navigates an evolving global landscape.