Introduction

India’s retail finance industry has witnessed significant growth, primarily driven by Non-Banking Financial Companies (NBFCs). These companies have expanded their retail books rapidly, catering to the soaring demand for credit in the country.

However, the industry is not without concerns. The rapid growth and intensifying competition have led to fears of a potential bubble forming in the market. The surge in lending, particularly in unsecured segments, raises questions about the quality of loans and the ability of borrowers to repay, especially in economic downturns.

One major concern is the Asset Liability Mismatch (ALM). As NBFCs aggressively expand their retail lending portfolios, there’s a risk of imbalanced maturity profiles between their assets (loans) and liabilities (borrowings). If short-term borrowings fund long-term loans, it can lead to liquidity issues if interest rates rise

or if there’s a sudden demand for repayment. This potential mismatch has led to questions about the resilience of NBFCs in the face of market volatility

Under RBI's Strict Vigilance: Navigating India's Financial Landscape

Amid these developments, the Reserve Bank of India (RBI) has a crucial role to play. Regulatory measures are essential to ensure the stability of the financial sector. The RBI’s actions, such as enforcing stricter rules on capital adequacy and disclosure, are crucial in mitigating risks associated with rapid expansion and asset

liability mismatches.

The Reserve Bank of India (RBI) has expressed concern about the rapid growth in unsecured lending by both banks and Non-Banking Financial Companies (NBFCs) in the country. Specifically, the RBI is closely monitoring certain personal loan categories, particularly tiny personal loans of up to 10,000 rupees, taken for three to four months, for signs of potential stress.

The central bank is particularly worried about the surge in these small personal loans and has cautioned banks and NBFCs about the risks associated with lending to borrowers with overdue debt. The share of lending to borrowers with overdue loans rose to 23% in fiscal year 2022-23 from 12% in fiscal 2018-19,

according to UBS. Additionally, the number of borrowers with multiple retail loans rose to 9.3% in fiscal 2022-23 from 3.9% in fiscal 2017-18.

"India's Retail Lending: Dawn of a New Era"

UBS has downgraded several Indian banks, citing increasing default risks in retail unsecured loans. The brokerage firm has raised its credit cost forecasts for Indian banks and has turned “neutral” on the banking sector. UBS also sees a higher probability of regulatory tightening on unsecured loans.

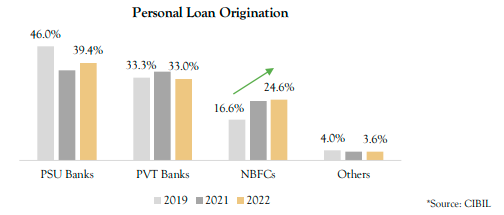

The RBI is particularly concerned about the outlier growth in the unsecured retail loan segment, which has grown by 23% in the last two years, compared to an overall credit growth of 12-14% in the system. The regulator has urged banks and NBFCs to be vigilant and take appropriate measures to handle potential risks upfront. Fintech companies have also been mentioned in driving the expansion of unsecured lending, catering to segments that traditional financial institutions might not reach.

RBI Governor Shaktikanta Das has emphasized the need for banks and NBFCs to strengthen their internal surveillance mechanisms and address the buildup of risks. He clarified that the RBI is not announcing any macroprudential measures at this point but expects financial institutions to be proactive in managing the risks associated with unsecured lending.

Consumer Demand Surges: Implications for India's Market Dynamics

The surge in household borrowing in India has raised concerns among regulators, particularly the Reserve Bank of India (RBI). Unsecured personal loans have gained significant traction within the Non-Banking Financial Company (NBFC) landscape, accounting for over 16.4% of the total retail portfolio of NBFCs, a proportion steadily increasing over the years. These unsecured loans are expected to form almost 18% of the retail book by the end of the current fiscal year, according to rating agency ICRA.

Despite the RBI’s cautious view on unsecured loans and increased scrutiny, there has been no slowdown in unsecured credit offtake. Borrowers are taking loans for various purposes, such as lavish weddings and travel, with a significant portion of unsecured loans disbursed having high ticket sizes, reaching up to Rs 30 lakh.

The growth in household borrowing is expected to continue, especially with the festive season upon India.

However, concerns persist about the potential consequences if economic growth slows down, leading to rising unemployment and impacting the ability of borrowers to repay their loans.

In the fiscal year 2022-23, Indian households made bank and non-bank deposits of Rs. 11 trillion but took out loans amounting to Rs. 15.82 trillion, marking the first year when Indian households became net borrowers from the financial system.

This shift in behavior is explained partially through the lens of the Life Cycle Hypothesis model, where individuals tend to borrow in the early stages of their careers when income is relatively low and then save as their earning potential increases. Given the relatively young median age of Indians (28 years old), it’s logical

"India's Retail Lending: Dawn of a New Era"

that a considerable portion of the population is in the early stages of their careers, justifying their inclination to borrow. Additionally, India’s economy is in good shape, with a robust GDP growth rate and a thriving services sector. The job market is strong, especially in the formal sector, leading to increased visibility in future earnings. This economic prosperity, coupled with advancements in digital technologies and financial visibility through initiatives like the India Stack and UPI, has facilitated easy access to credit.

These factors have allowed lenders to assess the creditworthiness of millions of borrowers, even those who previously transacted primarily in cash.

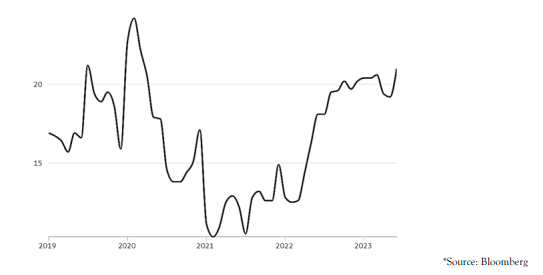

India’s personal loan growth accelerates from pandemic lows Personal loans, year-on-year growth (%)

Concerns About Unsecured Lending:

Rapid growth in unsecured lending is inherently riskier due to the absence of collateral, making it a cause for concern for the RBI. In case of borrower defaults, the lender’s ability to recover outstanding amounts is compromised, potentially leading to substantial financial losses for lending institutions.

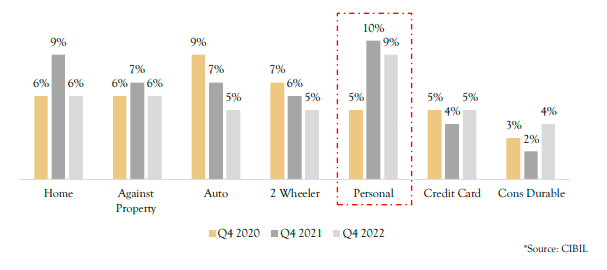

Small ticket unsecured lending has raised concerns due to stacking of loans by consumers. Data shows an increase in the share of outstanding personal loans to borrowers with multiple existing loans.

Consumers, especially those purchasing items below Rs. 20K, are heavily relying on financing options, with delinquency rates for loans under Rs. 50K already rising significantly. As reported by Reuters (using data from credit bureau CRIF Highmark), delinquencies for loans under Rs. 50K were at 8.1% as of June 2023, well above the 1.4% bad loans ratio for all retail loans as of March 2023. The same Reuters article said, “The total value of loans below 10,000 rupees grew 37% in the financial year ending March 31, 2023, while loans of 10,000-50,000 rupees rose 48%, according to CRIF data.”

"India's Retail Lending: Dawn of a New Era Vintage Delinquency

Actions by Prominent Lenders:

The resurgence of NBFCs, particularly market leader Bajaj Finance, amid these risks is noteworthy. Bajaj Finance has displayed strategic adaptability, expanding its customer base and product offerings. Its cautious approach, considering guardrails and being selective, has allowed it to maintain a relatively stable position, even as it faces challenges from newer players like Jio Financial Services (JFS). The entry of JFS, backed by the extensive network of Reliance Industries, poses a threat to established players like Bajaj Finance. JFS’s large customer base and access to significant capital present a formidable challenge to existing market leaders. However, Bajaj Finance’s confidence stems from its vast customer network, stable core team, and prudent expansion strategies, allowing it to maintain its market dominance.

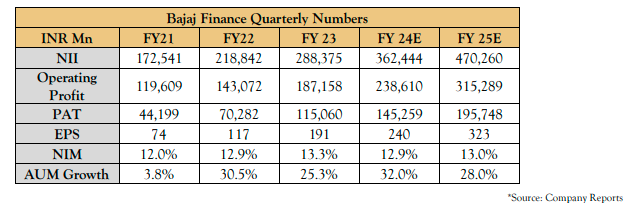

High-quality lenders like Bajaj Finance and HDFC Bank have proactively reduced their exposure to low-ticket unsecured lending, demonstrating prudent risk management strategies. These lenders have slowed down on unsecured loans, focusing on strengthening their balance sheets and risk management protocols. Q2FY24 Bajaj Finance: The loan losses and provisions for Q2FY24 stood at INR 10,771 Mn, an increase of 46.7% YoY/ 8.2% QoQ. Bajaj finance holds a management outlay of INR 7.4 Bn as of September 30, 2023.

It has released an amount of INR 1.0 Bn during the quarter. Stage 3 assets stood at INR 26,450 Mn as of September 30, 2023, as against INR 25,300 Mn as of September 30, 2022. The risk metrics across all businesses were stable except for Rural B2C businesses. The Company has taken risk actions in Rural B2C business, resulting in muted AUM growth in H1FY24. However, it expects this segment to recover from February 2024. It said that it has cut 8-14% of its low-ticket unsecured lending business across products owing to concerns of over leverage amongst these customers and imprudent behavior on the part of these borrowers.

Notably, before the Q2 FY24 results, Bajaj Finance announced a fundraise of Rs 100 billion of fresh equity capital. HDFC Bank’s Q2 FY24 results showed it has pulled back on unsecured loans as well. In Q3 FY23, HDFC Banks unsecured book grew 6.3% QoQ. In the latest quarter, the corresponding growth rate is down to 1.1%

"India's Retail Lending: Dawn of a New Era"

During the conference call, Bajaj Finance (BAF) shared several significant highlights and updates:

Growth in Customers and Loans: BAF added 3.58 million new customers, totaling nearly 45 million. They booked over 8.5 million loans in the quarter.

Business Expansion: BAF launched new car financing in 85 locations and initiated microfinance pilots in 12 villages in UP and Karnataka, with plans to expand to 100 locations by March 2024 and potentially 300 villages by March 2025.

Financial Health: The company maintained a robust liquidity buffer at INR 114 billion. The cost of funds stood at 7.67%, with expectations of adding 13-14 million new customers in FY24E.

Financial Strategy: BAF’s board approved raising capital of INR 100 billion, intending to list the housing finance business within eight quarters.

Performance Metrics: The company observed positive trends in customer engagement, with 35% of service requests coming through consumer initiatives. Product Per Customer (PPC) improved from 5.81 to 5.97, indicating effective cross-selling.

Challenges and Resolutions: BAF faced a temporary change in asset quality due to a unique phenomenon, but this is expected to normalize in the next quarter.

Conclusion

In summary, while India’s retail finance industry continues to expand, the sector faces significant challenges.The focus on NBFCs’ asset liability management, the emergence of new players like JFS, and regulatory interventions by the RBI are crucial factors determining the industry’s future. Prudent risk management and

regulatory oversight are paramount to ensuring the stability and sustainability of India’s retail finance sector

This report has been prepared by 3Q Private Wealth and is meant for sole use by the recipient and not for circulation.The report and information contained herein is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of 3Q Private Wealth .The report is based on the facts, figures and information that are considered true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from publicly available media or other sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. 3Q private wealth will not treat recipients as customers by virtue of their receiving this report.