June 2022 CPI Review

Apr 3, 2023 | 2022(June), Blog

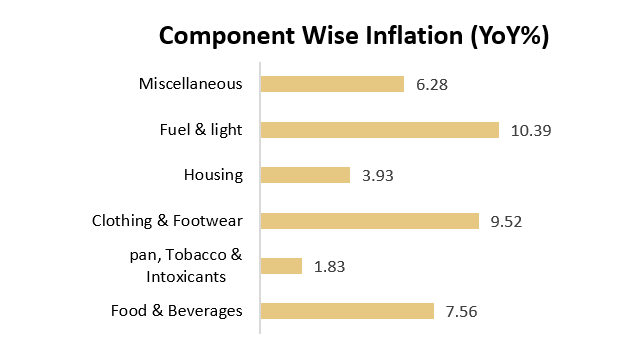

CPI inflation increased to 7.01% in June’22 from 5.58% in June’21 owing to global inflation headwinds & weakness in rupee. Overall price levels in June’22 however inched up 0.52% from the previous month, highlighting the underlying persistent price pressures. This is the sixth consecutive month that the CPI data has breached the Reserve Bank of India’s (RBI) upper margin of 6%.

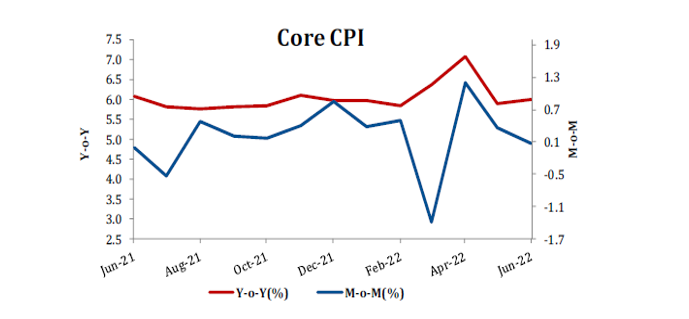

Inflation during the month continued to be driven buy food, fuel & light segments. Core Inflation although still elevated- reflecting the board-based characteristics of the prevailing prices pressures, eased to a 3 month low of 6.02% (YoY growth).Furthermore, rural inflation rose marginally even as urban inflation eased.

Key Highlights

-Headline inflation stayed at near about same levels since the last month. Crude prices have dwindled in July’22 which is anticipated to ease CPI in the near month.

-Additionally, good monsoon prospects are expected to ease food inflation.

-Various fiscal and monetary measures helped control inflation, which is expected to stay at near about the same levels due to continued measures.

-However, there remains a risk of global inflation, recessionary pressures, and volatility in crude prices and depreciation in rupee. The RBI is likely to take a relatively gradual approach to its monetary tightening process in its upcoming monetary policy in August.

Domestic prices could see some moderation in the coming months given the decline in global commodity prices. Inflation would nevertheless prevail above the RBI’s upper target for the foreseeable future.

-Persistent price pressures would prompt further tightening by the RBI. We expect the RBI to undertake additional rate increase of 50 to 75 bps in the remainder of FY23 that would take the repo rate to 5.40% to 5.65%.