RBI Maintains Status Quo: Highlights from the Monetary Policy Announcement

8th February, 2024

Summary: The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) recently announced its decision to keep key policy rates unchanged. RBI Governor Shaktikanta Das highlighted some important points:

• Repo Rate Unchanged: The MPC decided to maintain the repo rate at 6.5 percent.

• Economic Update: Governor Das mentioned robust economic activity, a decrease in CPI inflation, and the resilience of the services sector. The government is focused on fiscal consolidation, and the agricultural sector is performing well despite challenges.

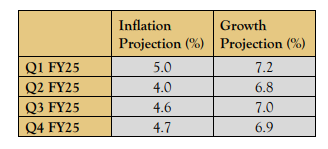

• Growth Forecast: Real GDP growth for FY25 is projected at 7 percent, with quarterly growth rates ranging from 6.8 to 7.2 percent. For the current year, 2023-2024, the projected CPI inflation rate stands at 5.4%, with Q4 projection at 5%. Looking ahead to FY25, the projected inflation rate is estimated to be 4.5%

• Liquidity Measures: While systemic liquidity has shifted to a deficit, liquidity in the banking system remains surplus. The Indian rupee’s exchange rate is market-driven and stable despite global economic conditions.

• Retail and MSME Loans: Banks are required to provide Key Fact Statements to enhance transparency for retail and MSME loans.

• Digital Transactions: A framework for authenticating digital payment transactions has been introduced to improve security.

• Review of ETP Framework: The RBI will review the framework for electronic trading platforms to adapt to market developments.

• Macroeconomic Stability: Proactive policies have maintained and strengthened macroeconomic and financial stability.

• Paytm Regulatory Action: Regulatory action against Paytm Payments Bank aims to address persistent non-compliance and protect consumer interests.

Overall, these updates reflect the RBI’s cautious approach, prioritizing stability, transparency, and responsiveness to changing economic conditions and market dynamics.

Market Reaction

• BSE Sensex tumbled 700 points while Nifty fell nearly 1 percent, dragged by banking stocks. PSU Banks were the clear outliers, with the PSU Bank index up over 3%, Whereas the laggards came from Auto’s FMCG & private banks which caused the drag.

• The Indian rupee held stronger than 83 per USD, remaining close to the two-week high of 82.95. The yield on the 10-year Indian government bond was little changed around 7%