Steering India’s Steel Sector Globally

Apr 3, 2023 | Blog

The Indian steel sector is modern and has always strived for continuous modernization of older plants and up-gradation to higher energy efficiency levels. As of October 2021, India was the world’s second-largest producer of crude steel, with an output of 9.8 MT.

Being a major stakeholder in the global steel market, steel production and consumption is a critical part for many sectors such as infrastructure, construction, engineering and packaging, automobiles, and defense. It is an indicator of modernity, and the sector’s development is linked to the development of a country. Sectors that utilize finished steel are construction (62%), capital goods (15%), automotive (9%), intermediate products (6%), consumer durables (5%), and railways (3%).

India’s finished steel consumption is anticipated to increase to 230 MT by 2030-31 and demand for steel is expected to increase by 17% to 110 million tonnes, driven by rising construction activities. Government initiative to invest in roads, railways, metro, industrial parks, DFC, transportation of water, oil & gas, transmission towers and affordable house has helped in post covid recovery and also increased demand for steel.

GLOBAL MARKET

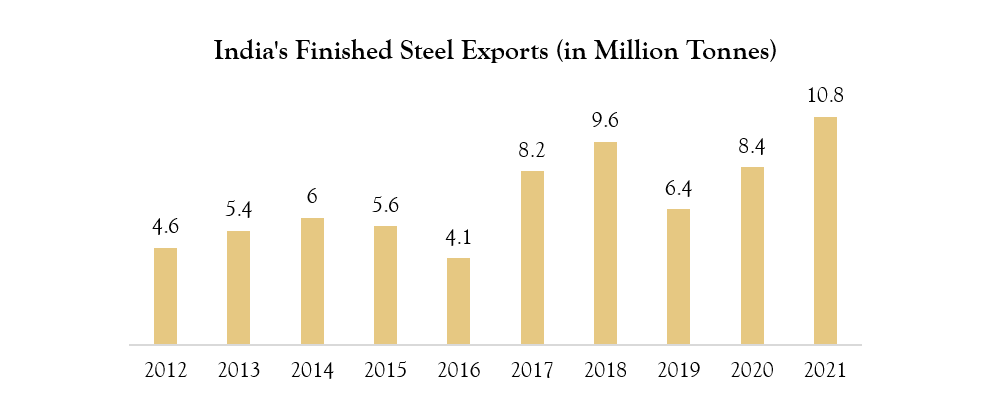

India is a net steel exporting nation and exported 13.5 MT of finished steel in 2022. Easy availability of low-cost manpower and presence of abundant iron ore reserves make India competitive in the global set up. The industry is witnessing consolidation of players, which has led to investment by entities from other sectors. Also, countries exports increased due to foreign trade agreements with countries like Japan and South Korea, and steps taken by the government of India to boost the growth of the steel industry. In addition, prices in international markets were high as of 2021, causing exports to rise.

In FY22, Vietnam accounted for most of India’s steel exports, accounting for 1.70 MT. Exports to Europe and the Middle East, particularly HRC (hot rolled coil), increased India’s overall exports for the year. Furthermore, the UAE was the second-highest importer of Indian steel. Increased steel production over the last decade has greatly reduced India’s dependency on imports, despite high domestic demand and usage of steel.

ROAD AHEAD

India’s steel industry has experienced tremendous growth over the past few years, however India’s steel exports will drop 35%-40% to 10-12 MT this fiscal following the 15% export duty imposed on several finished steel products, a CRISIL research analysis shows.

Steel exports, which had reached a record high of approximately 18.3 MT last fiscal, continue to see momentum because of the disruption caused by the ongoing Russia-Ukraine conflict.