Expansion in Industrial Output: May’22

Apr 3, 2023 | 2022(May), Blog

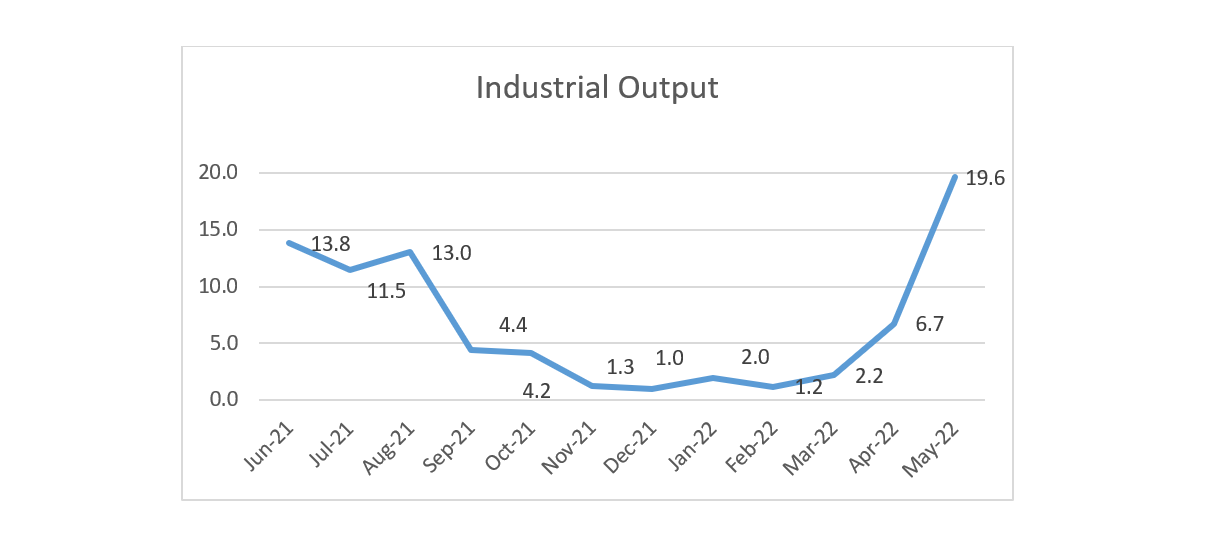

Industrial output as measured by the index of industrial production in May’22 grew by a strong 19.6% from a year earlier, the fastest rate of growth in 11 months. This high growth rate is mainly due to statistical factors i.e., the low index value in June’21 which was a period of the second wave of the pandemic and associated restrictions which impacted industrial output. Industrial production nevertheless has been witnessing an improvement. All segments of the IIP registered growth from a year earlier.

Output in May’22 was 1.7% higher than the pre-pandemic period of May’19. On a sequential basis also, output was up 2.3%. All segments of the index of industrial production (IIP) witnessed strong growth from a year ago except consumer non-durables. However, manufacturing output is yet to attain the pre-pandemic production levels i.e., of May’19. Similarly, capital goods and consumer goods production remains lower than that period. This is reflective of the weakness in investment demand and consumer demand.

Despite the favorable growth momentum of the last two-months, industrial output in the coming months could be weighed down by higher input costs and rise in cost of funds. Also, it need be seen if consumption and investment demand improves in a durable manner and herein there lies significant uncertainty.

Segment-wise output

- Electricity output strengthened on an annual as well as sequential basis. Output grew 23% YoY and monthly by 2.8%. Output from the sector was 13% higher than May’19.

- Manufacturing sector output in May’22 has been 21% higher than a year ago and 2% more than Apr’22. However, when compared with the pre-pandemic period of May’19 it was lower by nearly 1%.

- Mining output in May’22 was nearly 11% higher than May’21 and up by 9% from April’19.

- Consumer goods gains have been limited. Although consumer durable and non-durable goods improved on an annual basis in May’22, the output for consumer non-durable contracted month-on-month by 1.7%. Also, consumer durables and nondurable output was lower than May’19 by 15% and 9% respectively. This indicates the demand for consumer goods remains weak.

- Capital goods production was 54% higher than a year ago but 8% lower than April’19. This is reflective of the lackluster investment demand in the economy.

- Infrastructure/ constructions good output has expanded by 18% in May’22 YoY and is nearly 6% higher than May’19. This can be attributed to the government capital expenditure program.