RBI MPC MEET – Key Takeaways – August 2022

Apr 3, 2023 | 2022(August), Blog

Summary

Even as inflation is expected to have peaked, the RBI has proceeded with yet another sizeable rate increase, the third in a row at its just concluded monetary policy meet. With the latest hike of 50 bps (higher than our expectation of 25 to 35 bps), the key policy or repo rate now stands at 5.40% which is the level last seen in Sep’19. The central bank is continuing with its stance of calibrated withdrawal of monetary policy accommodation. The overall tone of the policy and the RBI commentary that followed has been more aggressive than was the general expectation. While the cycle of rate hikes is likely to be carried forward, the RBI stayed away from providing future guidance on quantum and pace of rate action going forward.

Inflation Outlook

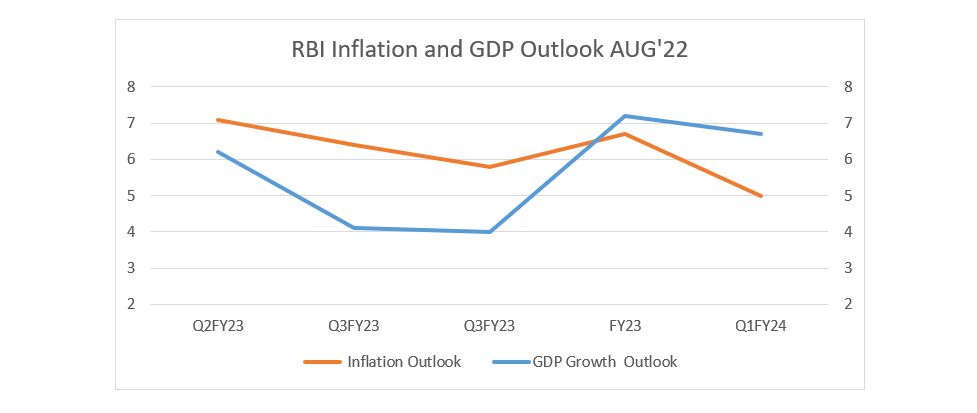

The RBI retained its June’22 outlook for economic growth and inflation for FY23. The inflation outlook for FY23 has been unchanged at 6.7%. However, changes have been made in the quarterly projections – for Q2 (Jul-Sep’22) inflation outlook has been scaled down to 7.1% (by 0.3% from the June’22 estimate) and it has been raised by 0.2% to 6.4% for Q3. Inflation is expected to fall below the RBI upper target range only in the Q4, that too marginally (at 5.8%). The central bank observed that there is considerable uncertainty to the domestic inflation trajectory owing to the spillover from the geo-political shocks. Moreover, despite the recent cooling of food and metals price from their peaks, price remain elevated. The RBI has factored crude oil prices at $105/bbl, same as in the June’22 policy

GDP Forecast

In terms of economic growth, the RBI has been sanguine. It has retained it growth outlook of Apr’22. The domestic economy is projected to grow by 7.2% in FY23. This is lower than the IMFs growth outlook of 7.4%. The RBI sees the domestic economic activity strengthening. The upswing in the economy has been an enabling factor for the aggressive rate hikes.

Immediate Market Reaction

- The benchmark 10- year GSec yields rose to 7.29% from the previous days’ close of 7.16%.

- Equities rose immediately after the policy announcement but decline later in the session.

- The Nifty was seen trading marginally below than the previous trading day close (by 0.09%)

- The Rupee weakened by 0.03% to INR 79.23/ USD