FOMC Meeting

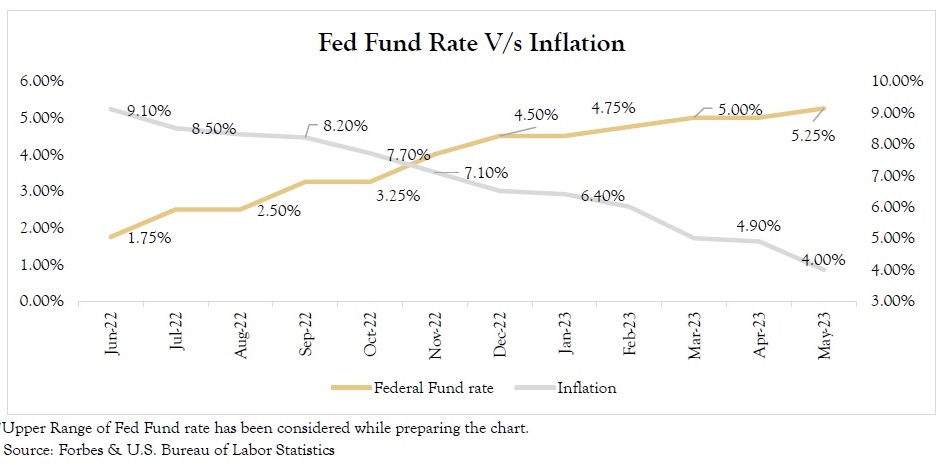

June 15, 2023 Federal Reserve Chairman Jerome Powell-led Federal Open Market Committee (FOMC) decided unanimously to keep the Fed funds rate or the benchmark US interest rate at which the Fed lends money to commercial banks unchanged at 5-5.25%, a first pause in 15 months of back-to-back increases. This decision was in line with expectations of markets as well as economists. Holding interest rates steady gives policymakers on the FOMC time “to assess additional information and its implications for monetary policy,” the Fed said. But Fed officials also forecasted two more quarter point hikes in its economic projections this year. It also forecasted unemployment to average 4.1% in the fourth quarter, compared with 4.5 per cent projected in March. The official jobless rate at 3.7% in May. For 2023, the median estimate for US gross domestic product (GDP) growth was marked up to 1 per cent from 0.4% in March. Market Reaction All indices were trading in red. Dow 30 was down by over 300 points as Fed points to more rate hikes. The yield on the 10-year treasuries was little changed at 3.81%. Gold price pared gain after Federal Reserve kept interest rate unchanged. Spot gold was up 3% and US gold futures settled 0.5% up. On Contrary, oil prices fell 1.5% as US Fed projected more interest rate hikes. FOMC Dot Plot & Central tendencies from June 2023 meeting: ➢ The dot plot for 2023 shows the end-of-year terminal target rate of 5.6% vs 5.1% in March 2023. ➢ The FOMC dot plot for May 2023 show the median rate at the end of 2023 at 5.6% versus 5.1% in March 2023. ➢ For 2024 & 2025, the median fed funds target rate is 4.6% & 3.4% respectively in March.