RBI MPC Meet – Key Takeaways – September 2022

Apr 3, 2023 | 2022(September), Blog

Summary:

Beginning its 3 day meeting on September 28, Monetary Policy Committee (MPC) continued its recent trend of tightening rates by global central banks. This rate hike comes amid high levels of inflation and uncertainity associated with commodity prices (global & domestic).

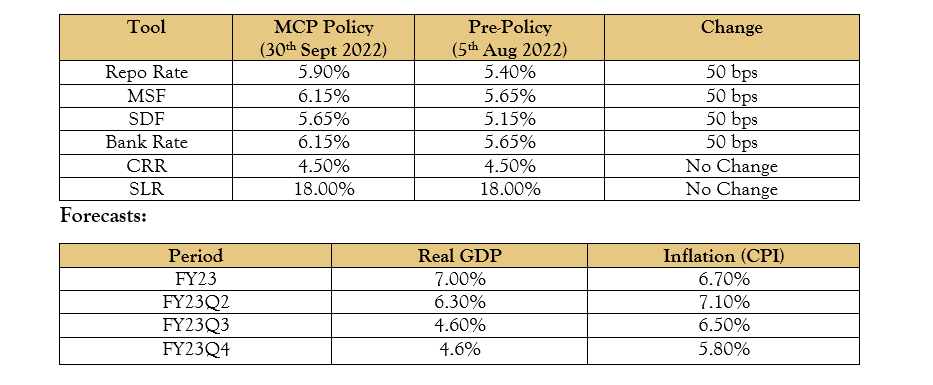

Given below is the data released by RBI today during its MPC Meet:

Market Reaction

Investors heaved a sigh of relief as interest rate raised as per the expectations and the RBI maintained accommodative stance despite liquidity unwinding by global central banks.

RBI this moved has a positive impact on market as BSE Sensex climbed 571 points and NSE Nifty too advanced 145 points and settled at 17,784 on Sept 30, 2022. On the sectoral front Nifty metal index was biggest gainer rising 2%. Another sector which has gained due to this meet is banking sector (2% rise).

This rate hike has further reduced the gap between inflation and interest rate which currently stands at 7%.

With the festive season round the corner, the higher loan demand is expected to help banking companies to improve their margins. It is also expected that RBI rate is also positive for the rupee which has fallen over 7% since April this year. With higher interest rates, banks will have more liquidity now as they are expected to attract more savings from the account holders.