6th August 2025,

After three consecutive rate cuts, the Reserve Bank of India (RBI) opted to maintain the repo rate at 5.5% during its third bi-monthly monetary policy review for FY2025–26, held on Wednesday, 6 August. RBI Governor Sanjay Malhotra stated that the central bank has adopted a neutral stance, balancing declining inflation against rising global tariff uncertainties.

Since February 2025, the RBI has cut interest rates by 100 basis points (1%). The reductions were made in three phases: 25 basis points each in February and April, and 50 basis points in June, as inflation steadily fell below the central bank’s comfort level.

Highlights of the RBI Policy Decision:

Following keeping repo rate unchanged, the RBI adjusted other key rates as follows:

▪Standing Deposit Facility (SDF) Rate: 5.25%

▪Marginal Standing Facility (MSF) Rate: 5.75%

▪Bank Rate: 5.75%

This decision aligns with the RBI’s dual mandate of anchoring inflation near the 4% target while continuing to support economic growth amid evolving global and domestic conditions.

Growth And Inflation Outlook:

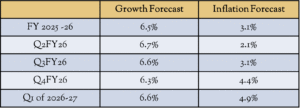

RBI Governor Sanjay Malhotra reaffirmed that the central bank has retained its GDP growth projection at 6.5% for FY2025–26, supported by robust rural demand, steady consumption trends, and favorable monsoon conditions.

Meanwhile, the inflation forecast has been revised downward to 3.1% from the earlier estimate of 3.7%. This adjustment reflects a broad-based easing in inflationary pressures, primarily driven by declining food prices and a sustained moderation in overall price trends.

Liquidity Surplus

Governor Malhotra highlighted that the system continues to remain in liquidity surplus. As of August 1, India’s foreign exchange reserves stood at $688.9 billion, sufficient to cover over 11 months of merchandise imports—a sign of strong external stability. He further noted that bank credit grew by 12.1% in FY25, surpassing the 10-year average, signaling healthy momentum in lending activity and underlying economic strength.

Economic Outlook

▪India’s economy is showing signs of strength, supported by:

▪Steady rural demand and consumer spending

▪Rising government investment

▪Good monsoon progress aiding agriculture

▪Strong performance in construction and services sectors

▪However, industrial growth remains mixed, especially in sectors like electricity and mining.

Rationale for MPC Decisions:

Inflation has eased more than anticipated, particularly in food prices, while core inflation remains stable with some mild upward pressure. The economy is still absorbing the impact of previous rate cuts. While growth remains on track, emerging global risks like new trade tariffs are starting to cloud the outlook. In this environment, the RBI has decided to hold off on further action for now and wait to see how conditions evolve.

Market Reaction:

Markets reacted mildly to the RBI’s decision to hold the repo rate at 5.50%. The Nifty traded below 24,650 and the Sensex slipped under 80,700. Rate-sensitive sectors like banking, NBFCs, and realty declined, with the Nifty Realty index down 2.3%. Bank Nifty, PSU Bank, and Financial Services indices fell 0.2% each. Midcaps dropped nearly 400 points, and Small caps lost around 1%.

Upcoming MPC Meetings:

Next MPC Meet: 29th Sept – 1st Oct 2025