4th September 2025

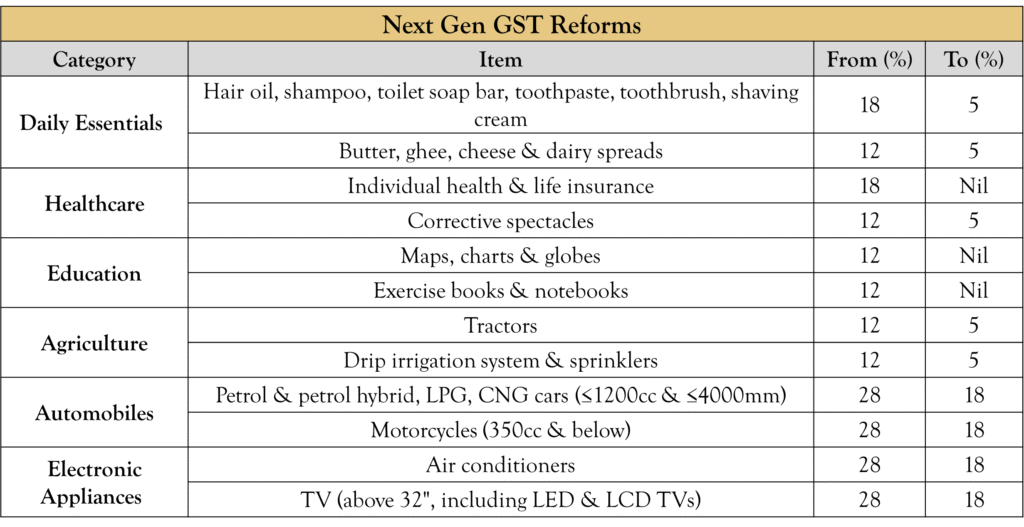

At its 56th meeting, which lasted over 10 hours, the GST Council approved next-generation reforms to the eight-year-old indirect tax regime, introducing a simplified structure of two main slabs—5% and 18%—along with a 40% demerit rate for super luxury, sin, and demerit goods. Aimed at reducing the tax burden on common people, the reforms feature sweeping rate cuts, rationalization of slabs, easier compliance through automated refunds and registration, and measures to ease blocked working capital. Except for tobacco and related products, all rate changes

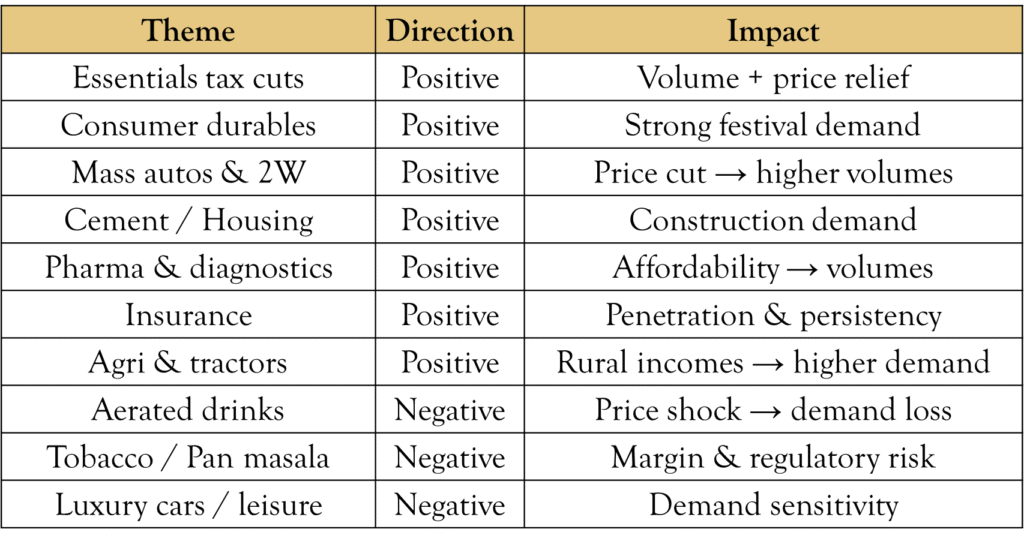

Sectoral Winners

- FMCG / Personal Care: Staples such as toothpaste, shampoos, and soaps now taxed at 5% or nil, driving stronger demand across both rural and urban markets.

- Consumer Durables: Rates on ACs, TVs, and dishwashers reduced to 18% from 28%, likely to trigger a seasonal boost ahead of the festive period.

- Automobiles (Mass + EV): Small cars and motorcycles up to 350cc moved to 18% from 28%, while EVs remain at 5%, lowering on-road prices by an estimated 6–8%.

- Cement / Construction: Cement rate reduced to 18% from 28%, supporting affordable housing demand and infrastructure projects.

- Healthcare & Pharma: 33 life-saving drugs moved to nil, with diagnostics, oxygen, and medical devices taxed at 5%, improving affordability.

- Insurance: GST on life and health insurance reduced to nil, enhancing penetration and policy persistency.

- Agriculture & Rural Economy: Tractors, irrigation equipment, and fertilizer inputs taxed at 5%, lowering farmer input costs, boosting rural incomes; tractor parts (gearboxes, pumps, tyres) also down to 5% from 18%

Sectoral Losers

- Aerated & Caffeinated Beverages: Tax rate raised to 40% (from 28%), reducing affordability and likely dampening demand, especially in Tier 2 and Tier 3 markets.

- Tobacco & Pan Masala: Shifted to a 40% slab (earlier 28% plus cess), creating margin pressures and adding to regulatory risks for the sector.

- Luxury & Premium Automobiles: Petrol cars above 1,200cc and diesel cars above 1,500cc moved to the 40% bracket, expected to moderate luxury demand and push consumers toward smaller vehicles.

- Leisure & Gaming: Casinos, race clubs, and IPL tickets taxed at 40%, making discretionary spending more expensive and likely curbing demand.

Macro Impact

- Fiscal Impact

The implementation of GST 2.0 is expected to have short-term fiscal implications. The government’s own estimate pegs the revenue loss at approximately ₹48,000 crore. However, alternative assessments suggest a much wider range, between ₹93,000 crore and ₹1.6 lakh crore for both Centre and states combined, after accounting for cess conversion. In terms of the economy, this translates to roughly 20–26 basis points of GDP. While non-trivial, policymakers and analysts consider this impact manageable in the context of higher consumption-driven revenues over time.

- Inflation Impact:

On the inflation front, GST 2.0 carries a disinflationary bias. If the full extent of the tax cuts is transmitted to consumers, the reform could lower headline CPI inflation by up to 1.1 percentage points. The key categories likely to benefit include food staples, personal care products, cement, small cars, and household appliances. By reducing the tax burden on these everyday consumption items, the reform not only supports household purchasing power but also creates space for more accommodative monetary policy

- Growth Impact

The growth outlook is significantly bolstered by GST 2.0, as lower indirect tax incidence is expected to spur demand across critical sectors. While estimates vary, projections point to a GDP uplift ranging from a few basis points to as much as 1–2 percentage points, depending on the speed and scale of the consumption response. This makes GST 2.0 both a structural reform and a short-term demand stimulus for the Indian economy.