8th April, 2025

India: Under Pressure, Yet Poised for Opportunity

Indian equity markets have experienced a broad-based correction in recent months. Key contributing factors include elevated valuations, a moderation in GDP growth, and reduced fiscal support. In response, the Reserve Bank of India has undertaken rate cuts and injected liquidity to help stabilize the domestic economic environment.

Meanwhile, the reappointment of former U.S. President Donald Trump has reintroduced global trade friction, particularly through a renewed focus on tariffs and protectionist policy. Markets initially viewed these developments as political signaling, but recent policy implementation has heightened risk sentiment globally.

U.S. Tariff Policy: Disruption and Structural Limitations

The new U.S. tariff framework applies duties in proportion to the trade deficit with each partner country. This has created uncertainty across global supply chains, particularly for countries who export more into the US than they import.

Notably, the ability of the U.S. to internalize global production is structurally constrained:

- Labor costs in emerging economies are significantly lower than in the U.S.

- Multinational supply chains (e.g., Nike’s ~500,000 workers in Vietnam) cannot be replicated domestically in the short or medium term.

- Rebuilding end-to-end manufacturing ecosystems would likely take decades.

These realities underscore the necessity — not optionality — of globalization.

India’s Strategic Response and Economic Resilience

India has acted with pragmatism:

- Initiated early diplomatic engagement with U.S. counterparts post-election.

- Demonstrated tariff flexibility on selected goods.

- Signaled willingness to participate in multilateral trade realignments (with 70+ countries).

From a macro perspective:

- India’s export exposure to the U.S. is limited (~3–4% of GDP).

- CPI inflation is under control (~4%), with WPI at ~3%.

- The Indian Rupee remains relatively stable; policy support continues.

Sector Perspective:

Pharmaceuticals: Global cost leadership remains intact. India accounts for ~40% of FDA-approved manufacturing sites globally. Even with tariffs, Indian generics offer irreplaceable value to the U.S. healthcare system.

Crude Oil Decline: A Positive Offset

Brent crude has corrected from ~$80 to ~$60/barrel.

For India:

- Every $10 drop translates to ~$15–20B in annual savings.

- Oil imports (~80% of domestic consumption) mean this acts as a strong macro cushion — potentially offsetting export-related headwinds.

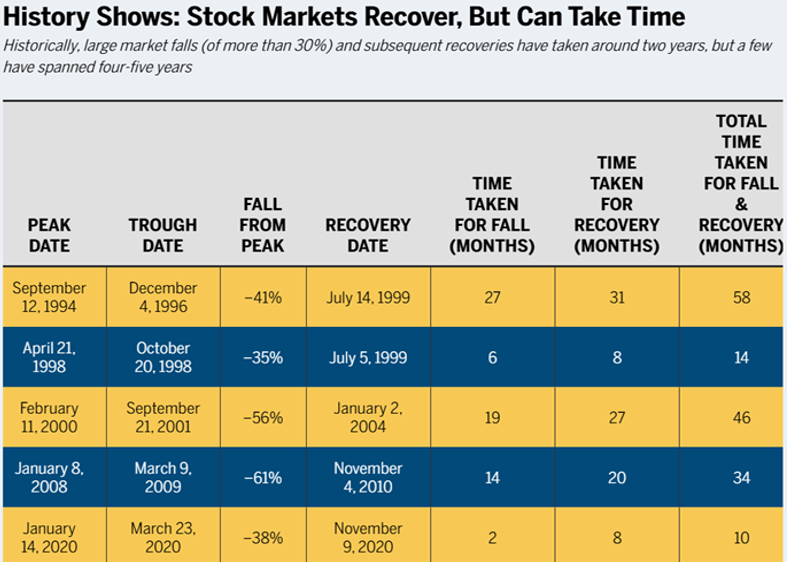

Don’t Panic: Equity Markets Have a History of Recovery

Watching equity markets drop sharply can be unsettling for any investor. However, it’s important to remember that markets have weathered many downturns over the years—whether due to wars, pandemics, financial crises, or recessions. These disruptions have typically been short-lived. Historically, equity markets have shown a tendency to recover and grow over the long term, driven by expanding economies and increasing income levels. The most important thing for investors is to stay calm and avoid reacting out of fear. Shifting investments into cash at this point could lock in current losses and cause you to miss out on the next market rebound. A reminder that hindsight is easy, but making calm decisions in uncertainty takes wisdom.

“Patience is not simply the ability to wait – it’s how we behave while we’re waiting.“ – Joyce Meyer