8th August, 2025

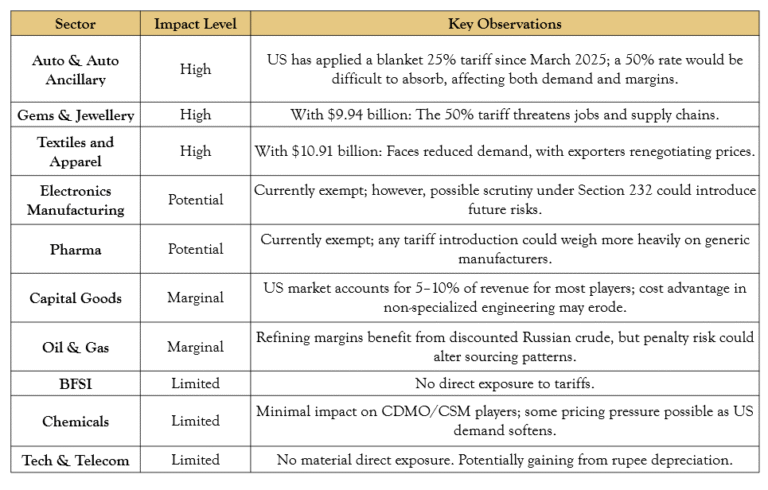

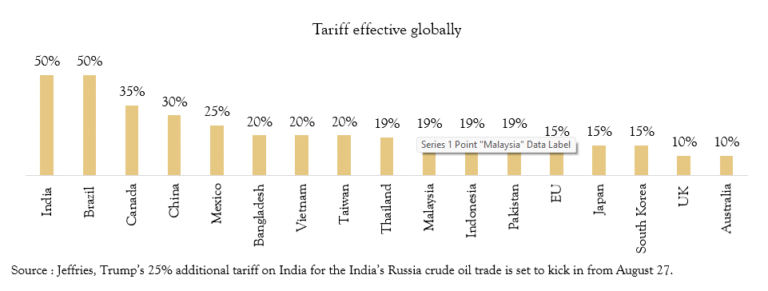

The United States has announced a 25% tariff on Indian imports, along with an additional 25% penalty tied to India’s trade with Russia. These measures, effective in 21 days, take the announced tariff rate to 50% on the affected categories. Products under Section 232 investigation remain excluded from this penalty. This move lifts the effective US tariff rate on India to 33.8%, up from 18.8%. Notably, pharmaceuticals and electronics—which together make up around 30% of India’s exports to the US—are currently exempt.

India’s exports to the US account for approximately 2.3% of GDP, with electronics and pharmaceuticals representing about 0.6%. This leaves the non-exempt share at roughly 1.7% of GDP, though the actual domestic value addition is closer to 1.1%, given the high import content in segments such as gems and jewellery. This exposure is meaningfully lower than that of several other Asian economies facing similar tariff hikes.

Economic estimates suggest that a 25% tariff, if sustained, could reduce GDP by around 25 bps, while a 50% tariff could lower GDP growth by 70–80 bps, primarily through direct export effects.

The recent penal tariffs appear to be driven by two primary US concerns: India’s refusal to grant tariff-free access for American agricultural and dairy products, and its continued import of Russian crude on grounds of economic and energy security. Conceding to US demands on dairy would risk undermining decades of progress toward self-sufficiency in the sector, and the government has made it clear that protecting farmers and the domestic dairy industry remains non-negotiable.

Despite US President Donald Trump’s decision to double tariffs, India is aiming to finalize a Bilateral Trade Agreement before the additional 25% duty takes effect in 19 days. Negotiations are being conducted at the highest levels, with ministries reviewing sectoral positions to determine whether offers can be enhanced without compromising core interests. US trade representatives are expected in India from August 25 to 30, with agriculture and dairy market access likely to remain a sticking point. In parallel, the government is pursuing a three-pronged strategy to cushion the economic impact of higher tariffs.

Key among these efforts is diversifying export markets—a goal already advanced by the recently concluded UK–India Free Trade Agreement (July 2025) and the anticipated EU–India FTA (expected by end-2025). These initiatives aim to reduce reliance on the US, broaden trade relationships, and support long-term export resilience. Our portfolio strategy reflects this evolving landscape.

We remain vigilant in monitoring global trade developments and stand ready to adjust sectoral exposures proactively, ensuring that investor interests are safeguarded even in a shifting geopolitical and trade environment.