9th April, 2025

RBI Goes Accommodative: Repo Rate at 6% After April MPC Meet

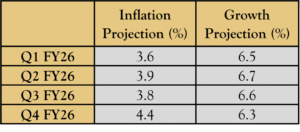

Summary: In its April 2025 meeting, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC), led by Governor Sanjay Malhotra, cut the key policy repo rate by 25 basis points to 6%, citing softening inflation and global uncertainties. The policy stance was shifted from “neutral” to “accommodative”, signaling a readiness to support growth. While the RBI lowered GDP growth projection for FY26 to 6.5% (from 6.7%), it expects inflation to remain contained, with FY26 CPI projected at 4%, down from 4.2% earlier. The move follows a similar 25 bps cut in February and is aligned with market expectations amid a moderate inflation environment.

Key highlights from Governor Sanjay Malhotra’s speech

- Repo Rate Cut: Repo rate reduced to 6%, SDF to 5.75%, MSF & Bank Rate to 6.25%

- Policy Stance: Changed to ‘accommodative’ from ‘neutral’

- UPI Transaction Limits: NPCI to determine P2M transaction caps in consultation with stakeholders

- Co-lending Norms: Extended to all regulated entities and all types of loans

- Gold Loans Regulation: RBI to introduce new prudential and conduct norms

- Securitization of Stressed Assets: Proposed market-based mechanism alongside ARCs

- Current Account Deficit (CAD): Expected to remain sustainable aided by strong services exports and remittances

- Liquidity Update: System liquidity was in deficit of ₹3.1 lakh crore in January 2025

Regulatory Sandbox: To be made theme-neutral and ‘on-tap’ for continuous innovation

Market Reaction

Indian markets ended lower amid global trade tensions and weak Q4 earnings sentiment. The Sensex fell 379.93 points to 73,847.15, while the Nifty dropped 136.70 points to 22,399.15. Market breadth was negative, with more stocks declining than advancing.IT, banking, and realty stocks dragged indices down, with Wipro, SBI, and Tech Mahindra among top losers. Meanwhile, FMCG majors like Nestle, HUL, and Tata Consumer gained as investors moved toward defensives. The BSE Midcap and Smallcap indices fell 0.8% and 1%, respectively. Except FMCG (+1.5%) and Consumer Durables (+0.3%), all sectoral indices closed in the red. The rupee weakened 45 paise to 86.69/USD amid global risk-off sentiment and rising U.S. bond yields. Trade war concerns, weak IT outlook, and pharma sector headwinds weighed on investor confidence, while domestic-focused sectors offered some resilience.