Fed delivers a smaller hike, indicating improved inflation outlook

Apr 3, 2023 | 2023(February), Blog

FOMC Meeting

February, 2023

On February 1, US Federal Reserve hiked its interest rate by 25bps taking the range to 4.50% – 4.75%. This 25bps hike represents yet another deceleration in the Federal Reserve’s monetary policy tightening campaign. The Central bank had already raised 50 bps in December meeting & 75 bps in each of its previous four meeting.

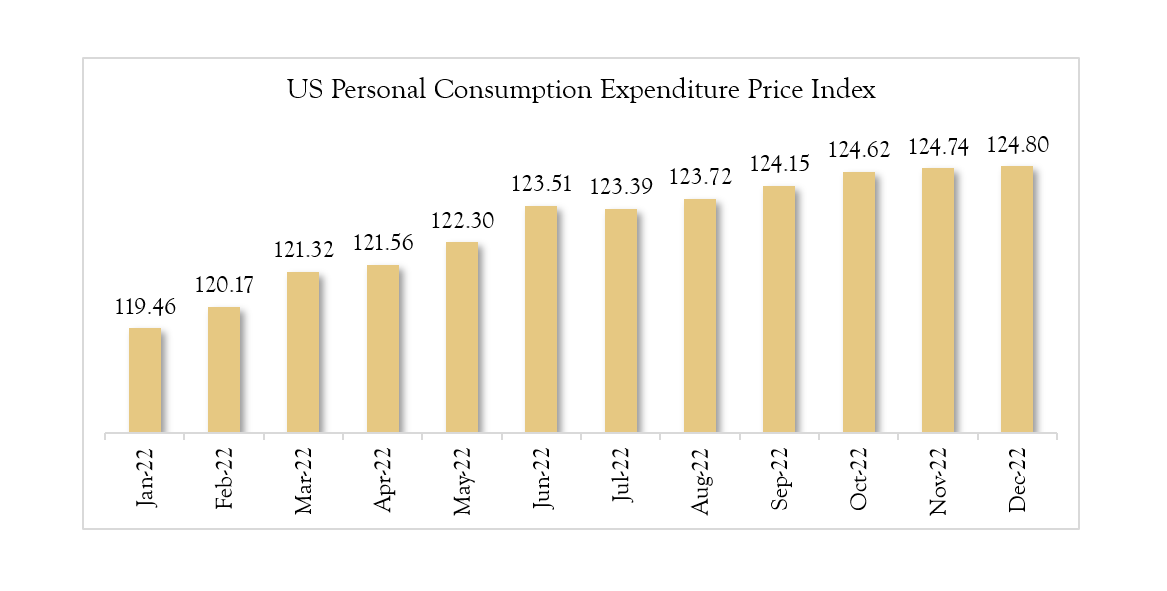

FOMC has been raising interest rates since march 2022 in an attempt to bring inflation 2% long term target. Fortunately, inflation has been trending steadily lower over recent months, which has allowed Fed to opt for smaller rate hikes.

Labour Department reported the consumer price index (CPI) rose 6.5% in December, down from 7.1% gain in November. Also, Commerce Department reported the core personal consumption expenditures price index (PCE) was up 4.4% in December. Core PCE in the Federal Reserve’s preferred inflation measure and its long term target for core PCE inflation is just 2%.

Fed Chair Jerome Powell in his post meeting press conference said, “While recent developments are encouraging, we will need substantially more evidence to be confident that inflation is on a sustained downward path.”

Market reaction:

US markets were trading at mix. Nasdaq Composite was up 1.50% while S&P 500 was higher by 0.77%, Dow 30 recovered from early losses and was trading flat.