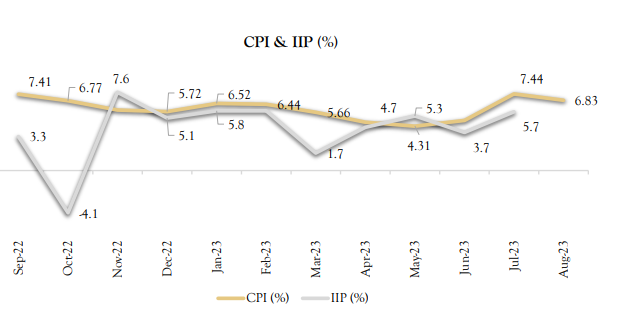

Retail Inflation eases to 6.83% in August, IIP grows at 5.7% in July

According to the data released by Ministry of Statistics & Programme Implementation on 12th September 2023, India’s headline retail inflation rate fell to 6.83% in August from a 15 month high of 7.44% in July 2023, this is mainly due to slide in prices of food items, especially vegetables. Despite slowing down, it continued to remain above the upper limit of the 4+/- 2% band of the Reserve Bank of India (RBI) medium term inflation target, making it the fourth instance of headline inflation staying higher than the upper limit of the target during this calendar year and the seventh such instance since August 2022.

Inflation has become a significant challenge due to rising consumer food price index (CFPI). CFPI eased to 9.94% from 11.51% recorded in July. Rural areas recorded 9.67% CFPI inflation while 10.42% was recorded in urban areas. During August food & beverages inflation rose to 9.19% as against 10.57% in previous month. Core inflation eased to 4.8% from 5% in the same duration.

In the last monetary policy committee meet held in August, RBI governor Shaktikanta Das had said that the central bank would continue to keep an eye on the rising inflation. The central bank’s MPC had kept the repo rate unchanged at 6.5%. As per the RBI projection, inflation is expected to remain above 5% till the

first quarter of 2024-25 and is likely to hit the 6.2% level in the ongoing quarter (July-September). Industrial Production India’s industrial output, as measured by the index of Industrial production or IIP, in July came at 5.7%. This July growth is above expectations of 5.0%. IIP Growth for July was driven by the mining & power sector. As per IIP data manufacturing grew by 4.6% in July, electricity generation saw a growth of 8% in July compared with 2.3% a year ago. Mining output grew 10.7% during the month against a fall of 3.3% a year ago, and the capital goods segment grew 4.6% compared with 5.1% a year ago. During the April-July FY24 period, the growth in IIP stood at 4.8%, down from 10% in the year-ago period.