RBI pauses for a second time in a row; the repo rate remains at 6.5%.

RBI pauses for a second time in a row; the repo

rate remains at 6.5%.

9th June, 2023

Summary

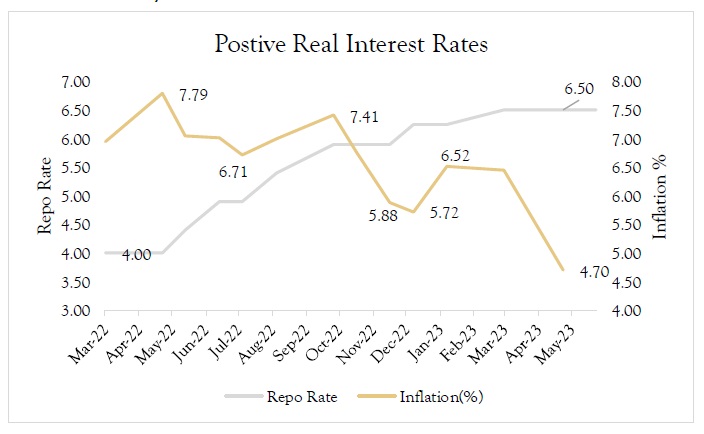

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) in its second bi-monthly monetary policy meeting of FY24 decided to leave the repo rate unchanged at 6.5%. This gave a relief to home, vehicle and other retail borrowers from an increase in equated monthly instalments (EMIs). The MPC voted 5 members to 1 to remain focused on withdrawal of accommodation. The MPC will continue to remain vigilant on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and bring down inflation to the target,” Das said. He, however, said that the rate action in the policy is “a pause and not a pivot”. “It is a pause in this meeting of the MPC. I have not said anything about pivot. So, whatever I said in the last (April 2023) meeting that it’s not a pivot, I reiterate that,” he said.

Inflation and Growth Projection

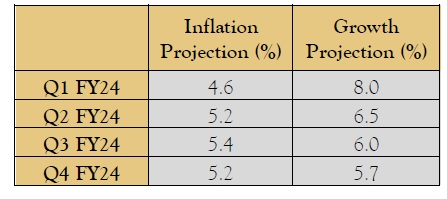

RBI Governor projected GDP growth for 2023-24 at 6.5%. The projection remains the same as the previous MPC statement that pegged growth for the year at 6.5%. Additionally, it marginally lowered its inflation forecast for FY24 from 5.2% to 5.1%.

Immediate Market Reaction

• Nifty closed lower after a volatile session on June 08, dragged down by weak global cues. At close, Nifty was down 0.49% or 91.9 points at 18634.6.

• Indian rupee closed marginally lower at 82.57 per dollar against previous close of 82.54.

• The yield on the Indian 10-year government bond was 7.021%, as investors digest the economic and monetary outlook.