Green Hydrogen – Fuel of The Future

Apr 3, 2023 | Blog

Introduction

You might have come across the terms ‘grey’, ‘blue’, ‘green’ being associated when describing hydrogen technologies. It all comes down to the way it is produced. Hydrogen emits only water when burned but creating it can be carbon intensive. Depending on production methods, hydrogen can be grey, blue or green – and sometimes even pink, yellow or turquoise.

Green hydrogen is hydrogen produced by splitting water by electrolysis. This produces only hydrogen and oxygen. We can use the hydrogen and vent the oxygen to the atmosphere with no negative impact. To achieve the electrolysis, electricity is needed. This process to make green hydrogen is powered by renewable energy sources, such as wind or solar. That makes green hydrogen the cleanest option hydrogen from renewable energy sources without CO2 as a by-product.

A purportedly cleaner option is known as blue hydrogen, where the gas is produced by steam methane reformation but the emissions are curtailed using carbon capture and storage. This process could roughly halve the amount of carbon produced, but it’s still far from emissions-free.

Hydrogen is emerging as one of the leading options for storing energy from renewables with hydrogen-based fuels potentially transporting energy from renewables over long distances – from regions with abundant energy resources, to energy-hungry areas thousands of kilometers away. Interest in green hydrogen is skyrocketing among major oil and gas firms. Europe is planning to make hydrogen a big part of its trillion-dollar Green Deal package. China is the top country that consumes and produces hydrogen more than anyone else, its current annual usage is over 24 million tonnes.

The demand for hydrogen reached an estimated 87 million metric tons (MT) in 2020, and is expected to grow to 500–680 million MT by 2050. From 2020 to 2021, the hydrogen production market was valued at $130 billion and is estimated to grow up to 9.2% per year through 2030. But 95% of the current hydrogen production is fossil-Fuel based, very little of it is ‘Green’.

Industry Usage

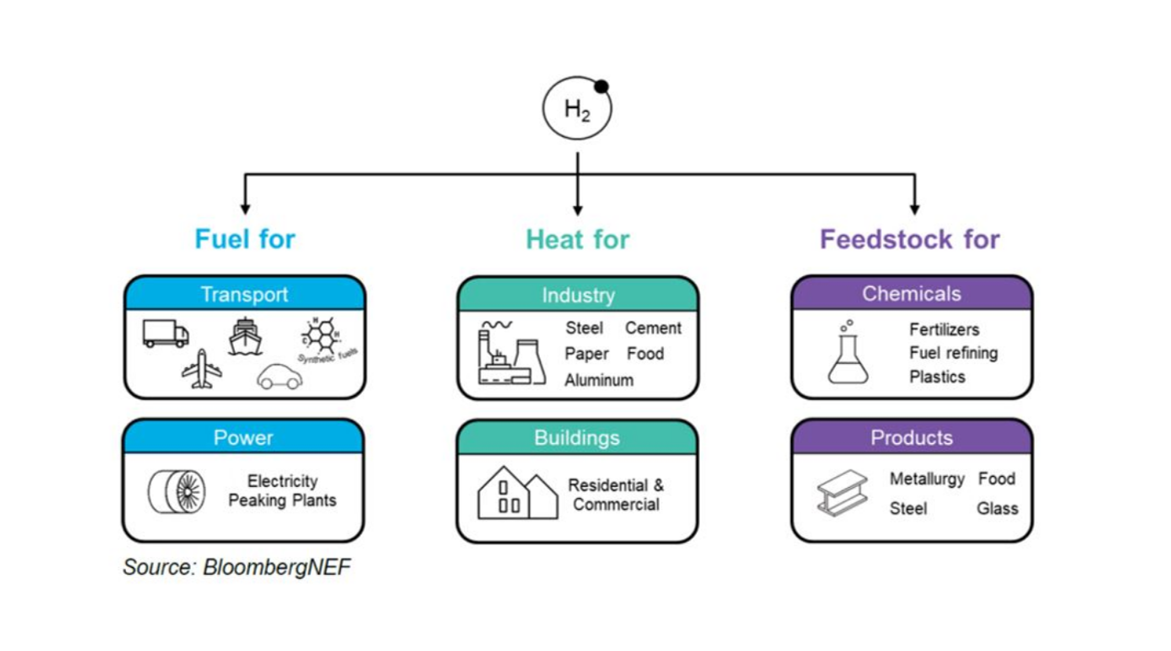

Hydrogen is already widely used by industry and is potentially very versatile, with possible applications in areas ranging from heating and long-term energy storage to transportation. The opportunity for green hydrogen to be applied across a wide range of sectors means there is a correspondingly large number of companies that could benefit from a burgeoning hydrogen fuel economy. Of these, perhaps the most significant are the oil and gas firms that are increasingly facing calls to cut back on fossil fuel.

There is an opportunity for rapid uptake of green hydrogen in the next decade where hydrogen demand already exists: decarbonizing ammonia, iron and other existing commodities. Many industrial processes that use hydrogen can replace grey with green or blue, provided CO2 is adequately priced or other mechanisms for the decarbonization of those sectors are put in production. In the coming years, ships can switch to green ammonia, a fuel produced from green hydrogen and nitrogen from the air, which does not contain CO2, but investments will be needed to replace engines and tanks, and green ammonia is currently much more expensive than fuel oil.

Expense

Green hydrogen is still expensive to produce today. In a report published in 2021, the International Energy Agency put the cost of green hydrogen at $3 to $7.50 per kilo, compared to $0.90 to $3.20 for production using steam methane reformation. Cutting the cost of electrolyzers will be critical to reducing the price of green hydrogen, but that will take time and scale. Electrolyzer costs could fall by half by 2040, from around $840 per kilowatt of capacity today, the IEA said. Moreover, falling renewable energy prices—coupled with the dwindling cost of electrolyzers and increased efficiency due to technology improvements—have increased the commercial viability of green hydrogen production.

Risks Associated

- High cost: Energy from renewable sources, which are key to generating green hydrogen through electrolysis, is more expensive to generate, which in turn makes hydrogen more expensive to obtain.

- High energy consumption: The production of hydrogen in general and green hydrogen in particular requires more energy than other fuels.

- Safety issues: Hydrogen is a highly volatile and flammable element and extensive safety measures are therefore required to prevent leakage and explosions.

Indian Market Outlook

Prime Minister Narendra Modi had launched the National Hydrogen Mission on August15 2021, which aimed to make India a green hydrogen hub and produce five million tonnes of green hydrogen by 2030.After years of dabbling, major oil companies are finally planning the kind of large-scale investments that would make green hydrogen a serious business.

Total Energies SE has joined Indian billionaire Gautam Adani’s conglomerate in a venture that has the ambition to invest as much as $50 billion over the next 10 years in green hydrogen. An initial investment of $5 billion will develop 4 gigawatts of wind and solar capacity, about half of which will feed electrolyzers producing hydrogen used to manufacture of ammonia.

Indian stainless steel producer Jindal Stainless plans to build a green hydrogen plant in the northern Haryana state with renewables developer Hygenco India, targeting commissioning in the third quarter of calendar 2023.The solar-powered plant will house an alkaline electrolyser that has a potential to produce up to 250 t/yr but is targeting initial production of 75 t/yr. RIL will invest Rs 75,000 crore in renewable energy businesses, a significant portion of which will be allocated for manufacturing electrolysers and hydrogen fuel cells. Heavy engineering major, Larsen and Toubro Ltd joined hands with renewable energy producer, ReNew Power, to invest in the entire value chain of green hydrogen technology.

Similarly, public sector energy companies are also expected to play a significant part in this domain. State-run energy major IOC Ltd., has announced setting up the country’s first dedicated plant for green hydrogen manufacturing in its Mathura-based refinery.

In August 2021, US-based renewable energy start-up, Ohmium International unveiled its electrolyser manufacturing capacity in Karnataka with an initial capacity of 0.5GW that can be subsequently ramped up to 2GW5. And, In October same year, RIL and Danish electrolyser manufacturer, Stiesdal, signed agreements to start local manufacturing in India. This could well be the start of a new industry that could support India’s economic growth in the coming decades

Battery powered-vehicles have an edge over hydrogen when it comes to cars and smaller vehicles. But their efficacy in long-distance transport has not yet been proven. This is where experts are betting on green hydrogen. According to CEEW Study 19% of India’s trucks will have to operate on hydrogen fuel cells if India were to achieve net-zero by 2070. In 2021, India’s largest commercial vehicle manufacturer, Tata Motors Ltd joined hands with Indian Oil Corp to conduct a trial with 15 hydrogen fuel-cell-powered buses. Others like Ashok Leyland Ltd are also in the process of testing their fuel cell-driven products. NTPC Ltd, the country’s biggest power generator has also floated a tender to procure hydrogen fuel-cell driven buses.

The union government plans to develop India as an export hub for green hydrogen and specifically for electrolysers. This is one of the prime targets of the National Hydrogen Mission. A thriving local production ecosystem will not only create a domestic market but is expected to push exports as well, especially to countries such as Japan, South Korea, Singapore, and others. Export is considered lucrative since companies draw higher profit margins. Therefore, companies investing in green hydrogen and related components will benefit if India evolves as one of the global export hubs. This would also offer India an opportunity to lead the energy transition and generate jobs that could make the transition just and equitable.

Disclaimer : All opinions, figures, charts/graphs, estimates and data included in this blog are as on date and are subject to change without notice. The content of this blog is not an investment advice and does not constitute any offer or recommendation of any investment product. It is for educational purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. The content is issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information / data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible / liable for any decision taken on the basis of this presentation.