The 3Q Story

The 3Q Story

Our DNA – The idea of “3Q” was conceived in 2016 by our founding partner, Siddhesh Dandekar. He realised that the market was saturated with investment specialists focused on selling financial products to the investors without asking the right set of questions or understanding their suitability. Coming from a Private Bank himself, he took time to understand what the market lacked. In-depth conversations with the investor community over months brought him to conclusion that most investors found it challenging to quantify the returns that satisfy them, and the risks they are willing to take to target those returns. They put a lot of emphasis on simpler aspects like the need to deal with someone capable, who has their interest in mind, and who could be there perpetually.

is trying to detect smartcards connected, or read certificate or use key for signing/encryption. Please select your option.

Licensed Sites

| Website | License Status | Features | Action |

|---|

Careful and patient probing with simple – 3 Questions like “Why are you investing”, “How do you react to volatility”, and “What is your unique story” made people open up and someone like Siddhesh, with a good grasp over behavioural finances felt that open ended answers to such friendly probing provided great insights about someone’s risk appetite, return objectives, time horizon, tax situations, liquidity needs, legal constraints and unique preferences. It also helped him understand both the willingness and capability to take risks, the cognitive and emotional biases that the investor exhibited and most importantly it gave a sneak peak into the unrecognised risks or needs. The foundation of 3Q was built around understanding the needs of large investors and working towards comprehensive management of their investment needs.

is trying to detect smartcards connected, or read certificate or use key for signing/encryption. Please select your option.

Licensed Sites

| Website | License Status | Features | Action |

|---|

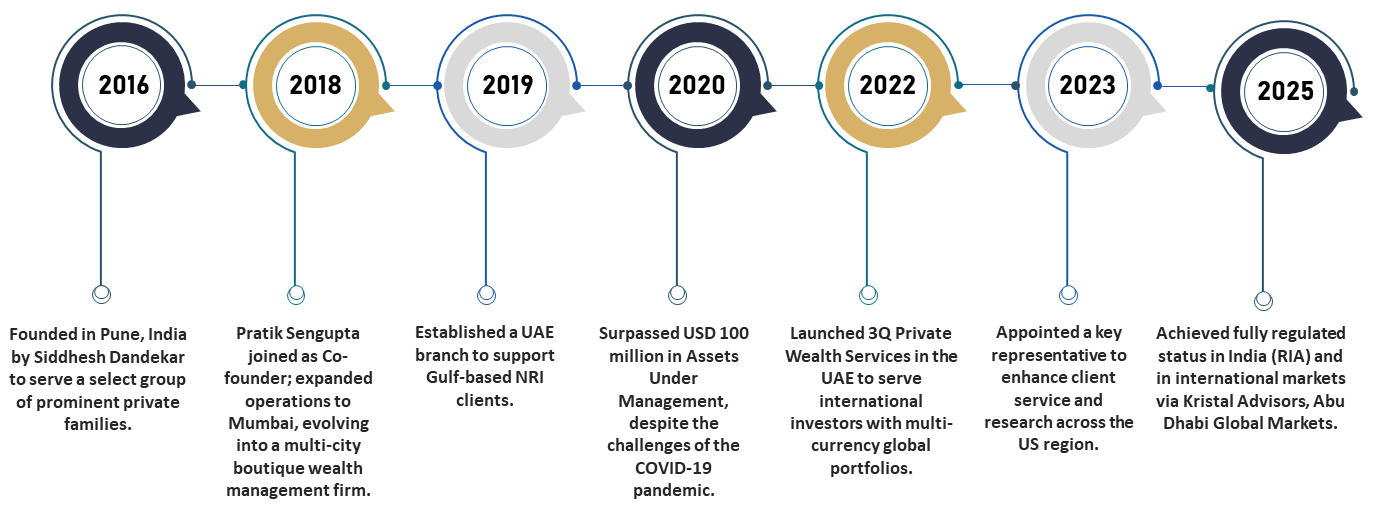

Time Line

Challenges – a familiar story?

The world is moving fast, and your core profession takes most of your time. You wish to make the right decisions, take the winning bets, know all the possible risks, you have a fear of missing out, you want to make appropriate changes in a timely manner. But information is endless, opinions are diverse and polarized, sentiments change too fast, products are plentiful, and nobody quite takes the effort to the real you. Your financial needs, wants and desires, your fears and reactions, your way of working and comfort factors, your motivations and turn-offs. You meet a lot of people and constantly hear about different products that show great past performances. You meet an Advisor who says yes to everything you opine, or you meet another who says everything you have done is wrong. You have questions that you need straight answers for, but what you get is jargon. You are sceptical about investing in geographies beyond your home country but are tempted to participate in the US tech story, or a China valuation play, or the superior India growth story, playing the US interest rates. Do these sound familiar?

You need a partner who has skin in the game. A knowledge partner who will do a thorough evaluation, create strategies, implement, control risks, monitor, suggest changes when necessary and help move towards your long-term goals. All these through thorough knowledge and capabilities-based investing on the back of real market experience and formal academic qualifications that are a prerequisite in today’s world to do a specialist’s job.

Everyone hates to change a stable partner. So do we. At 3Q Private Wealth, we walk “hand-in-hand” with our clients, as their knowledge partners, with a perpetual time frame.

is trying to detect smartcards connected, or read certificate or use key for signing/encryption. Please select your option.

Licensed Sites

| Website | License Status | Features | Action |

|---|

Logos & Strengths

- Global presence- We are where you need us.

- Knowledge based investing- Resources with the right academics

- Intentions and capabilities- We have your back

- Service Excellence- Pleasure of experiencing responsiveness

- Robust streamlined processes- Good returns are a by-product of good processes

You want to get in touch over an email, get on a call, or schedule an in-person/ digital meeting, we’re happy to address your questions directly. No bots, not copy paste answers, just you and us.

As a global boutique, we offer personal investment ideas, solutions and services for wealthy families and individuals. We’d be happy to meet with you for a personal consultation. Send us your contact details over an email and we’ll be in touch as soon as possible to arrange an appointment. Data privacy is strictly a hygiene policy for us.

is trying to detect smartcards connected, or read certificate or use key for signing/encryption. Please select your option.

Licensed Sites

| Website | License Status | Features | Action |

|---|

is trying to detect smartcards connected, or read certificate or use key for signing/encryption. Please select your option.

Licensed Sites

| Website | License Status | Features | Action |

|---|

is trying to detect smartcards connected, or read certificate or use key for signing/encryption. Please select your option.

Licensed Sites

| Website | License Status | Features | Action |

|---|