"Federal Reserve Policy Decision Sparks Record Highs: Impact on US and Indian Markets"

Summary

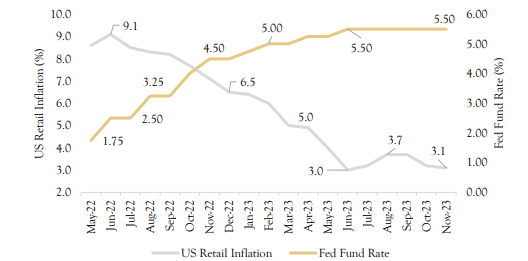

The Federal Reserve in the USA opted to maintain its key interest rates unchanged, holding steady in the range of 5.25% to 5.50%. This decision marked the third consecutive meeting without a rate adjustment, reflecting the central bank’s stance on easing inflation and economic growth moderation.

Key highlights include:

Interest Rate Forecasts: The Fed signaled an expectation of making 75 basis points cuts to their benchmark interest rate in 2024.

Economic Projections: Projections included a growth estimate of 2.6% for the current year, revised upwards from 2.1% in September, but with a forecasted slowdown to 1.4% in 2024. Inflation expectations also indicated a decrease to 2.8% in 2023, dropping further to 2.4% in 2024.

Market Response: Following the announcement, the US stock indexes surged by over 1%, and bond yields fell. Notably, the Dow industrials reached a record high, surpassing 37000 for the first time. Ten-year Treasury yields fell below 4.1% for the first time since August, settling at 4.032%. Two-year yields also settled at their lowest level since June. Apple shares reached a fresh record close, while Pfizer faced potential challenges, signaling its lowest close in years due to

projected revenue decline from decreased demand for Covid-19 drugs. : Benchmark U.S. crude oil climbed above $69 a barrel, rebounding from previous lows.

Comments by Fed Officials: Federal Reserve Chair Jerome Powell emphasized discussions on when it would be appropriate to begin cutting interest rates but didn’t rule out another hike. The Fed acknowledged the slowdown in economic growth but remained cautiously optimistic due to robust consumer demand and improved supply conditions.

Impact on Indian Markets

The Indian markets responded positively to the Federal Reserve’s indications: India’s benchmark stock indices, including the Nifty 50 and the S&P BSE Sensex, hit new record highs. The Nifty 50 climbed by 1.22%, and the Sensex rose by 1.34%.

Sectoral Gains: The information technology sector, witnessing a substantial 3.5% surge, notably boosted the Nifty 50 gainers, with companies like HCLTech, Tech Mahindra, LTIMindtree, Infosys, and Wipro leading the charge.

Global Market Influence: The surge in Indian markets followed a global rally triggered by the U.S. Federal Reserve’s indication of a possible end to its monetary tightening cycle, raising expectations for a rate cut in March 2024.

Fed Fund Rate Vs Inflation