US Inflation – August

Apr 3, 2023 | 2022(September), Blog

September 14, 2022

US inflation has remained hot topic for several months now. The reason for the same is whether US inflation has hit its peak or not. It seems that US inflation has hit its peak from the way equity market is reacting.

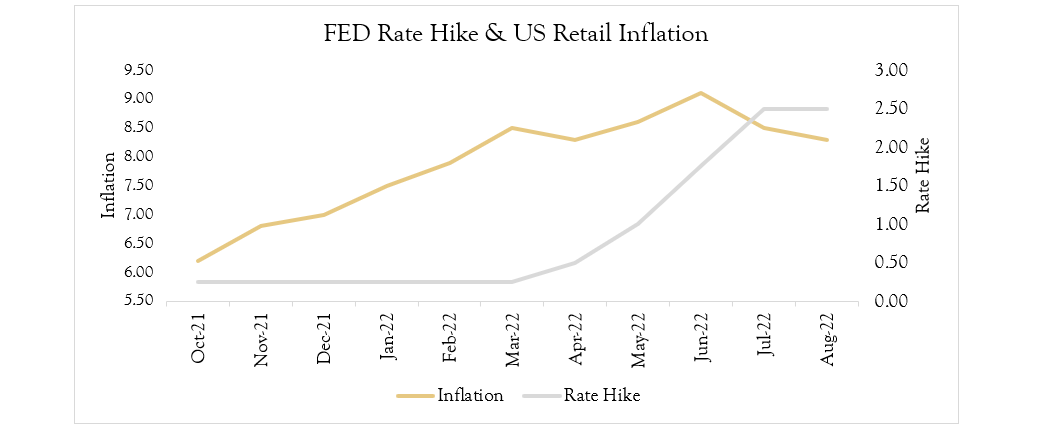

Exceeding the expectations of 8.1%, consumer price index (CPI) increased 0.1% in August and was up by 8.3% a year ago, according to the data released on Tuesday, 13th Sept 2022. This US inflation figures have forced for 75-basis-point rate hike from Federal Reserve next week (Market expectations). Core CPI, which strips out volatile food and energy prices, increased more than expected, rising to 6.3% from 5.9% in July. Though falling gasoline prices have helped inflation to moderate from its high point earlier but was not enough to offset rising rent, food and other prices last month.

US Inflation rose to 9.1% in June and later fell to 8.5% in July. Though the data shows declining trend core inflation is still a concern with economists, analysts and stock market investors. Core categories are major concern for FED as continue price pressures pose the risk of inflation becoming increasingly entrenched in the economy. One of the officials of the Federal Reserve said, “strong job growth and consumer spending this summer have put to rest fears that the country slipped into recession in the first half of the year”.

The markets in US sees the steepest day of declines since June 2020 as The Dow Jones average sank 4%, the S&P 500 dropped 4.3% and Nasdaq plunged more than 5% on 13th Sept 2022. The markets will also be looking out at how high FED could hike rates as FED remains committed to easing price pressure. According to leading analysts, “Liquidity withdrawals and interest rate hikes will continue in 2023 with the terminal rate topping out at 4.28%. The 10-year treasury yield will likely rise above 3.6% in coming months”.