India’s Credit Ecosystem

Apr 3, 2023 | 2022(November), Blog

24th November, 2022

India is one of the fastest growing economies & one of the elements of this thriving economy is financial inclusion, which comprises giving all people & organizations access to financial services and products that are suited to their requirements and available at reasonable prices. India is working on this feat by introducing new payment products and instruments that would make it easier to access formal credit. Traditionally, credit industry was limited to financial items such as home, auto & personal loans. However, banks & financial institutions have now shifted their focus on credit cards, buy now pay later (BNPL) & credit EMIs.

Credit demand in India has consistently increased over the time as the country’s financial industry has grown at an unprecedented rate. According to RBI data, total credit industry in India stood at ₹174.3 lakh crs, growth of 11% YoY. Main factors driving this growth are retail loans and growing use of credit cards.

Credit card industry

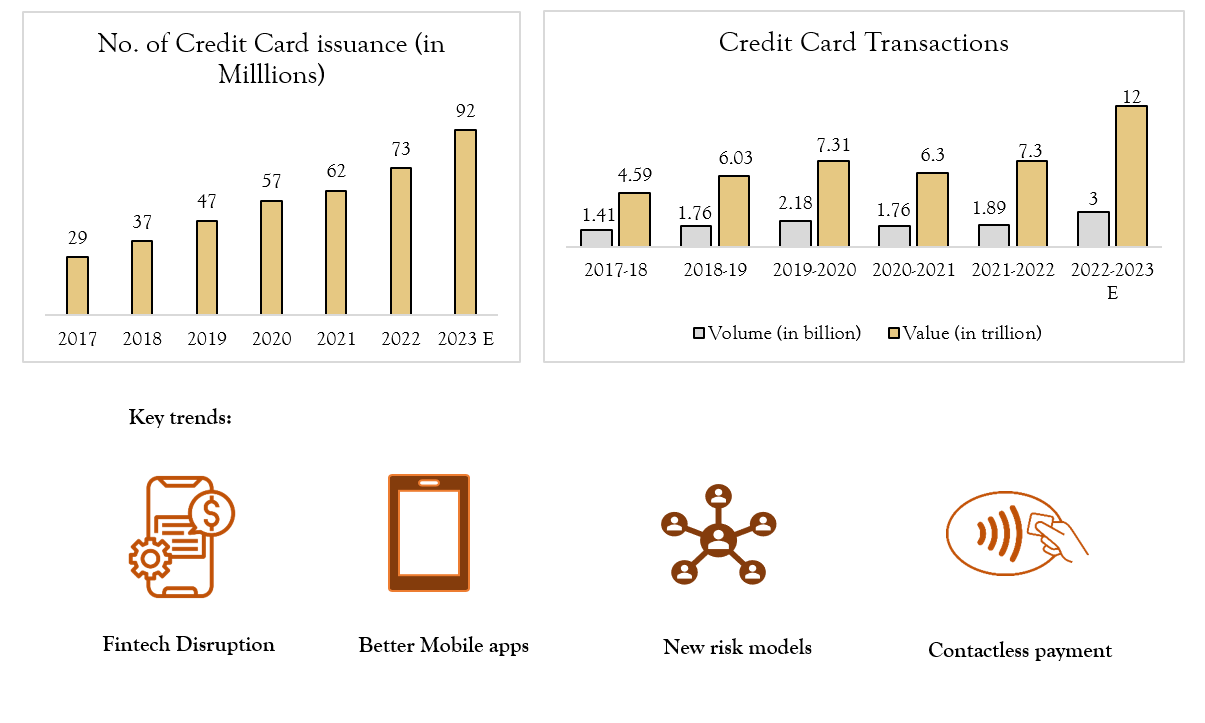

Credit card industry has seen tremendous growth in India. This growth is accelerated by various products & services offered by financial institutions such as differentiated card products, personalized offers & rewards & better mobile apps which have been beneficial for existing customers and also attracted new customers, especially millennials.

In last 5 years, credit card industry in India has seen a compound annual growth rate of 20%, whereas credit card issuance has crossed 78 million in July 2022. Along with credit card issuance, its transaction volume and value has increased to INR 11.5 million i.e., 1.8 times growth from FY 2020-21, where total spending for the year was INR 6.3 trillion.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later is a type of short-term financing that allows consumer to make purchases & pay for them at future date, often interest free.

BNPL market in India is one of the rapidly developing sectors in India. This is due to emergence of Ecommerce, digital payments & growth of Fintech companies. According to a fintech firm, in online Ecommerce payment segment BNPL has already captured 3% market share & is expected to grow up to 9% by 2024. This method is popular young millennials & first-time credit borrowers.

Key Features:

- Transaction limit ranges between Rs 1,500 – 25,000.

- Credit limit of up to INR 0.1 million with zero or nominal interest.

- Repayment cycle ranges between 15-45 days

- BNPL is a low cost/free source short term financing for people who have never had previous credit score.

- Revenue from BNPL comes from 2 sources:

- Merchant Fees: BNPL player has to pay this fee after every transaction and it ranges between 2-5% of the total value of payment.

- Late Payment: Late payment fee is charged in case customer do not repay before the due date. BNPL players impose a nominal late fee between 1-1.5%.

Consumer Durable Loans

Another formal credit which is expanding at a fast pace is consumer durable loans which is also know as credit EMIs. This growth is due to growing urban population, rising consumption and availability of low interest credit. A consumer durable loan is a type of credit that allows you to borrow money to purchase product that will last at least 3 years. It is a form of unsecured credit which means that unlike mortgage loan, your loan application will not be backed by any security. It is anticipated to increase in value at a CAGR of 21% from Rs 84 billion 2020-21 to Rs 205 billion in 2026-27.

Key Features:

- Consumer durable loans get approved within 24 hours and require minimum documents. KYC process can be completed using mobile numbers.

- Affordable interest rates & low processing fees. Interest rates are calculated on basis of your total income and other financial records.

- Provides loan in the range of Rs 5000 – 15 lakhs with a tenure of 36 month or less.

- No collateral required against the loan.

- Revenue model consists of

- Credit loan & Processing fees: Loan processing fees ranges between 1-3%

- Interest charged on credit card: No cost EMIs for repayment of consumer durable loans or retailer bears the interest though it’s shared with the lender in some cases.

Road Ahead:

The main reason for the growth of credit industry is due to introduction of fintech companies. Fintech companies have introduced the credit business to new untapped consumer categories and payment options like online & offline payments. These reforms have greatly benefitted the credit industry.

The RBI announced its intension to link credit cards & credit components of financial products to UPI in its Payment Vision 2025 document and is also planning to increase the number of credit card acceptance infrastructure to 250 Lakh touchpoints. Greater use of technology and innovation will position India as a major player in the global Payment business in the coming years.